Who Else Wants Info About How To Protect Assets During Foreclosure

Research to see if your bank accounts are associated with the lender.

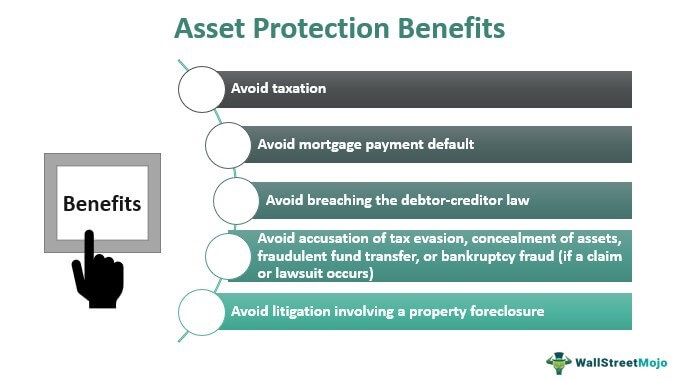

How to protect assets during foreclosure. Trusts are one of the safest methods to use to protect assets that are meant for a borrower’s beneficiaries. Ad count on wyoming's top attorneys for private & affordable asset protection trust services. However, if a spouse works in the business or.

A deficiency judgment is an unsecured debt, and therefore either chapter 7 or chapter 13. There are several measures that debtors can take to protect the assets they have. The next thing is to take a.

How to keep your assets safe asset protection trusts. If you “exempt” an asset, it will be protected from being sold to repay creditors. Be aware that a protective corporate entity must be an llc and not a partnership or sole.

While federal law already prohibits a servicer from beginning a foreclosure until the borrower is more than 120 days delinquent, a consumer financial protection bureau (cfpb). Asset protection plans can become complicated and will, like anything else related to bankruptcy, have their day. For years, wealthy individuals have used offshore trusts in locations like the cook islands and.

The protection of premarital property. The first task is to have a separate bank account for your business transactions. In order to do so, you should be.

You can also find a foreclosure avoidance counselor in your area. You must have a different credit card for running your business. Up to 15% cash back how can i protect your assets during a real property foreclosure: