Formidable Tips About How To Deal With The Irs

How to deal with the irs.

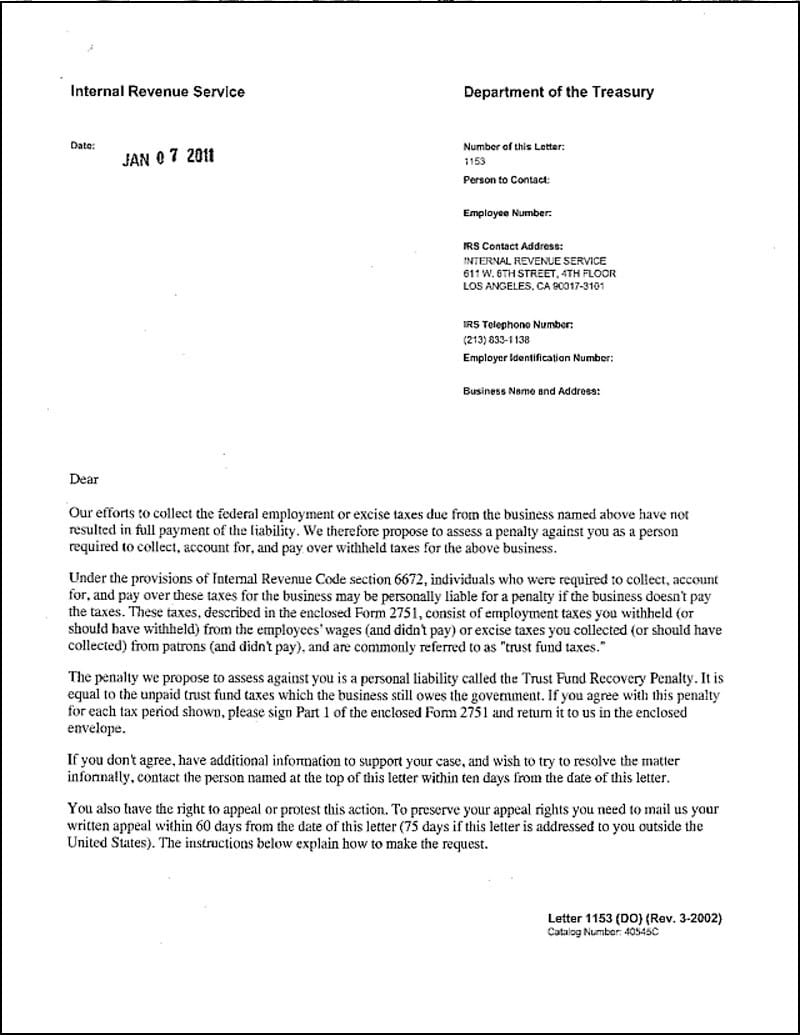

How to deal with the irs. Basically, taxpayers have three options for paying back taxes : The notice number and the. Settle irs & state tax problems.

Ad stop irs tax collections. Ignoring any irs letter or notice snowballs into a bad situation and can play into assessment of penalties if you owe tax. Period and type of tax;

While the irs does not have the. For an office audit, the irs will send you a letter listing a number of items they want to audit, and they will provide a telephone number to call to schedule the audit. Don't let the irs intimidate you.

You don’t want to miss any important notices or deadlines as this could set you back in your tax resolution case. The taxpayer may need to obtain an irs form called the. Contact the taxpayer advocate service (tas).

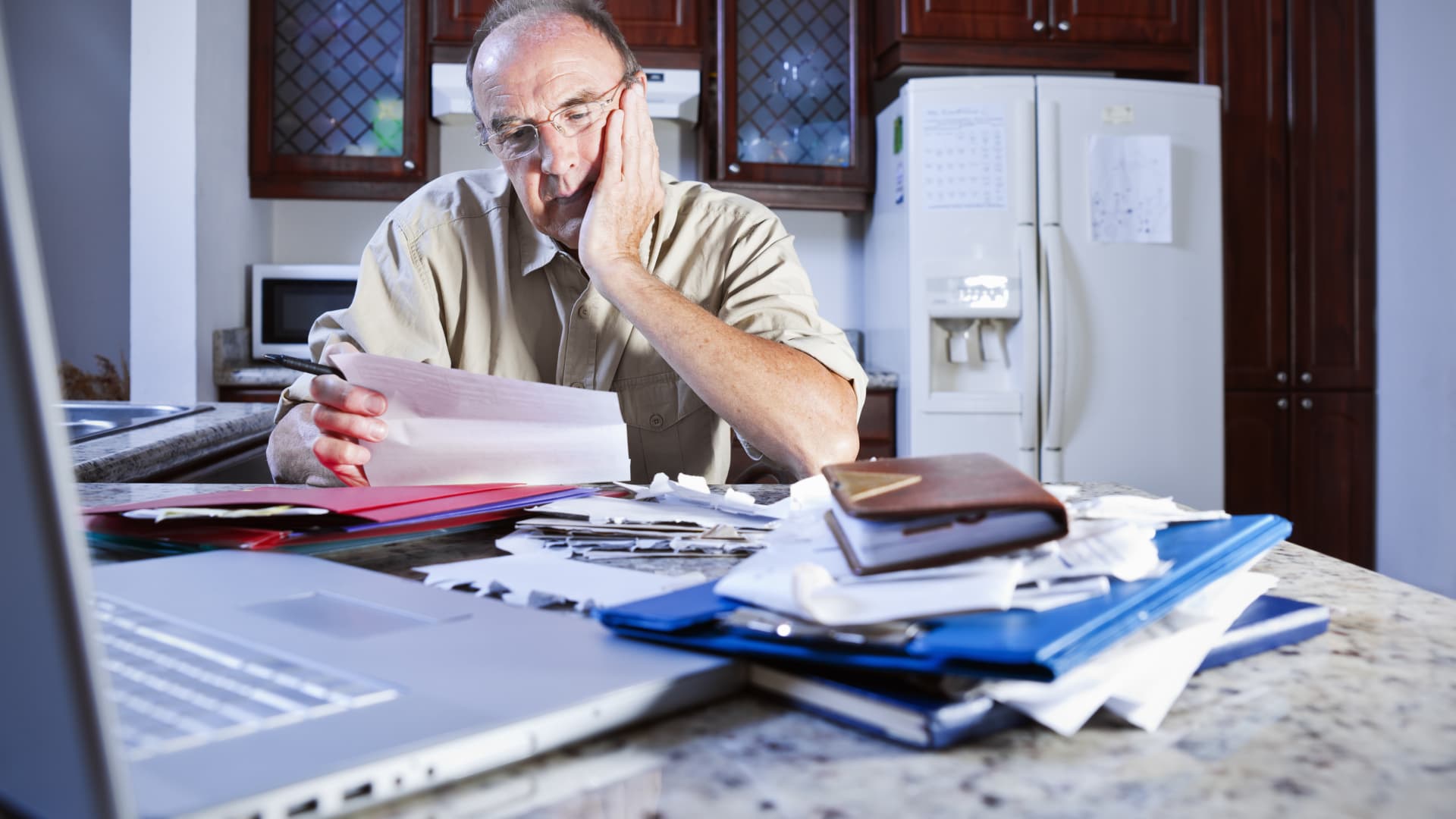

Get help from the best irs tax experts in the nation. Changes can create confusion, not only to us, but to the internal revenue service itself. Owing the irs back taxes can feel pretty stressful.

When the average taxpayer has to deal with the irs for any reason, whether due to an audit, an inability to meet their tax obligations or in order to negotiate a resolution so they. Under an installment agreement, a taxpayer pays the amount due over a period of time. Ad affordable & reliable services.